Quicken 2019 for Mac imports data from Quicken for Windows 2010 or newer, Quicken for Mac 2015 or newer, Quicken for Mac 2007, Quicken Essentials for Mac, Banktivity. 30-day money back guarantee: If you’re not satisfied, return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price. Quicken Starter 2018 (2-Year Subscription) - Mac|Windows This is the easiest way to manage your personal finances to ensure that you keep your checkbook register current. Reasonably priced and simple to use, Quicken Starter is the perfect way to organize your banking! To help you find the Best Home Loans, TopConsumerReviews.com provides you with an in-depth Quicken Loans Review. To see ALL of our reviews for the Best Home Loans, please Click Here Today, home loan rates and home prices are very favorable to the buyer.

If you mention the words 'Quicken for Mac' around financially savvy consumers, chances are you'll hear a lot of groans. That's been the consensus for this program over the years. While it might not stack up to the Windows version quite yet, there are improvements you may want to see.

Quicken on Monday released the 2018 Mac edition of its personal finance software, making upgrades in areas like bill payments and investments, but primarily transitioning to a subscription-only model with Starter, Deluxe, and Premier packages. Find helpful customer reviews and review ratings for Quicken Deluxe 2018 - 27-Month Personal Finance & Budgeting Software [PC/Mac Box] - Amazon Exclusive [Old Version] at Amazon.com. Read honest and unbiased product reviews from our users. I bought into Quicken 2018 from 2017 with the hope that Quicken had finally fixed the basic user interface issues, and once again they disappoint. Not only that, but now they're charging three times the money for the same clumsy, bumbling, awkward and dated program that it basically was in 2014. Quicken’s mobile app leaves a lot to be desired. It has a dismal 1.7 rating on 1,424 reviews in the App Store, and 2.8 on 2,475 reviews in Google Play. Most users complain about the app being painfully slow — a real problem if you’re at the store trying to figure out if something is within your budget.

Quicken set out to create a program that was at least comparable to its sibling, Quicken for Windows. Did it accomplish that goal? Many users don't think so, but they do recognize the improvements made in the program. Some of the most important improvements made include:

Quicken 2018 Reviews By Consumers

- A more user-friendly interface

- More cohesiveness between mobile app and Quicken for Mac

- More reporting options

Did Quicken accomplish what they set out to do? Keep reading to find out.

How Does Quicken for Mac Work?

One thing you should understand about Quicken for Mac: just likes its Windows counterpart, you must subscribe to the service. The subscriptions are available in one and two-year increments. This means every year (or two years), you must renew your subscription. Quicken offers three versions for Mac users:

- Starter: As the name suggests, it's a starter program, good for those who have never officially budgeted their finances. Don't expect any bells and whistles with this option.

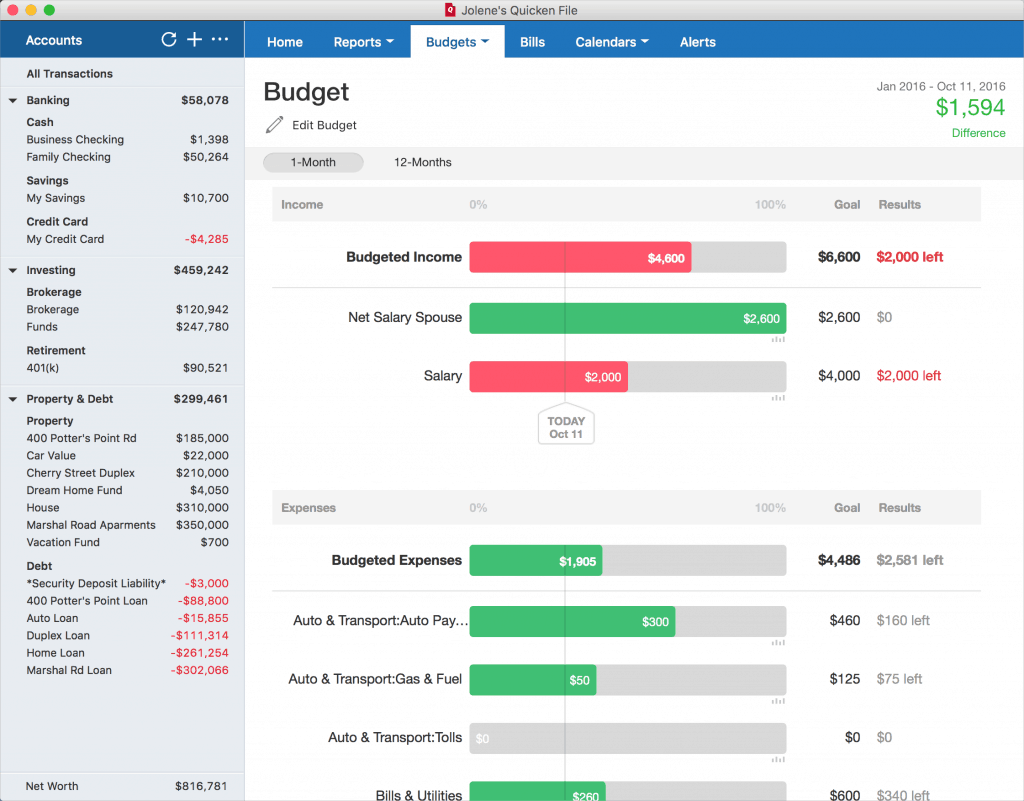

- Deluxe: If you are ready for more, the Deluxe program helps you customize your budget, track your debt, manage your debt, and monitor your investments.

- Premiere: The top tier program includes everything in Deluxe, plus online bill pay service (free of charge) and quicker access to customer service.

:

: Quicken offers two ways to contact customer support:

- Phone support is available Monday - Friday, 5 AM to 5 PM Pacific Time

- Live chat is available 24/7; you can see the wait time for an agent right on the website

What Are the Fees?

As we discussed above, Quicken is a subscription-based service. You will pay anywhere from $34.99 to $74.99 per year for the service. If you neglect to renew your subscription, you can still access your information, but you cannot use the program's services any longer.

Previously, Mac users had to run Quicken for Windows via VMWare Fusion or run an old version of Quicken for Mac. This allowed them to run Quicken on a Mac without having a program made for Mac. These users who now pay for the Quicken for Mac subscription can move their Quicken files over to Quicken for Mac. Quicken does offer full support to help you transfer the files, no matter how many years of transactions you have going at the time of transfer.

Reasons We Like Quicken for Mac

- You can sync your financial data between the desktop app and the mobile app. The Quicken mobile app is free and syncs with your desktop app. This way you can add, edit, or delete transactions on either device and they will synchronize the information so you are always looking at the most up-to-date data.

- You can easily reconcile your accounts. If you don't reconcile your accounts, you may be using incorrect information. Reconciling is a feature in Quicken for Mac that is simple to use. It's like a system of checks and balances that lets you know the information you put into Quicken for Mac matches the information the bank provides.

- Quicken for Mac provides visually appealing graphs and charts. Quicken for Mac is easier to navigate and read for users. You can view ledgers, graphs, or charts—whichever is the most appealing to you and will help you stay on track with your budget.

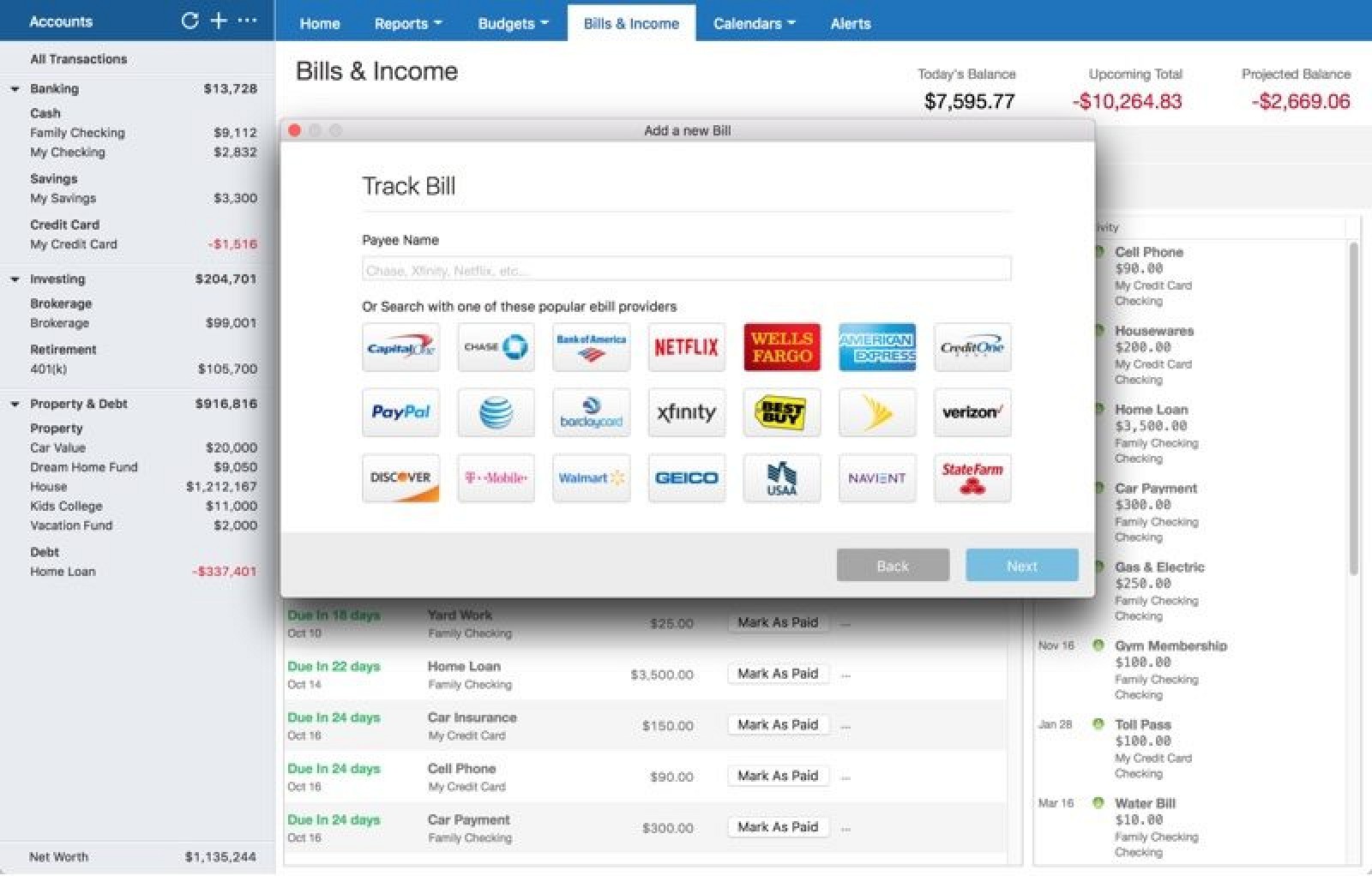

- You can pay bills via Quicken for Mac. Quicken for Mac has access to more than 11,000 vendors. You can view all of your bills on the dashboard and/or you can download your bills in PDF format if you prefer to have a copy of the bill yourself.

- You can manage your investments. A new key feature of Quicken for Mac is the investments feature. You can track your portfolio, get updated quotes, and track your profits. You can also see your cost basis, determine your capital gains, and prepare yourself for tax time.

- You can track your principal and interest on loans. If you are trying to get ahead of your loans, you will like the loan feature in Quicken for Mac. You can see how your payments affect principal and interest. You can also run 'what if' scenarios to see how different payments and scenarios would help you pay off your debt.

- You can use Dropbox for backups. Even though Quicken for Mac is on your local computer, you get access to 5 GB of online backup from Dropbox. This gives you a 'backup' of your financial information to ensure that you don't lose anything.

- You always have the latest updates. Because Quicken for Mac is subscription-based, you don't have to upgrade the product when new versions are released. You'll automatically receive updates, which means you'll always have the latest features available to you.

- You don't lose access to your financial data even after your subscription ends. If you don't want to renew your subscription, you still have access to your financial data. You can view it, edit it, or export it. While you can't use Quicken's features, you won't lose the information you collected while you did pay for the program.

- Quicken supports more than 14,000 financial institutions for automatic update of your financial information. This is the same number of financial institutions Quicken works with for the Windows version, so Mac users are on the same wavelength as Window users in that regard.

Reasons You May Want to Look Elsewhere

- There is little difference between the Premier and Deluxe versions. The only differences are the online bill pay (free of charge) and faster priority for customer service. For many users, that may not be worth the extra $30 per year, especially when most banks offer free bill pay.

- Investment reporting still lacks features offered in Quicken for Windows. While Quicken for Mac 2018 has dramatically better investment features, it still pales in comparison to Quicken for Windows' features. The main features that lag are in terms of reporting, which is the one feature many users want when looking at their investments.

- You have to pay for it every year. Quicken for Mac used to be a native program that you downloaded to your computer and used for as long as you wanted. If you wanted to use an old program, that was your prerogative. Now you don't have that choice—you have to pay the subscription fee or you can't use Quicken for Mac.

How It Compares

QuickBooks for Mac: QuickBooks for Mac offers similar features to Quicken for Mac, but QuickBooks also caters to small businesses. Quicken is more for personal finance use. If you don't manage payroll or your business has simple financing needs, Quicken may suffice. Businesses that need more robust financing options, though, may do better with QuickBooks for Mac.

Quicken for PC/Windows: While Quicken for Mac made many improvements for 2018, it's still not the mirror image of Quicken for Windows that many users want. The navigation in the Windows version is still easier. Also, the reporting options in the Windows version are more robust.

Reviews Of Quicken 2018 For Mac

Bottom Line

If you can overlook the subscription fees for Quicken for Mac, it does pack quite a punch being a native program for Mac users. While it does lack certain features, it's a major improvement over the previous versions.

Quicken Software For Mac

With the subscription-based service, you do have the benefit of quick fixes when issues arise and always having the latest version at your fingertips.

More from CreditDonkey:

|

|

|